For essentially the most susceptible borrowers, the effects of financial debt are far more crushing. Nearly just one-third of borrowers have financial debt but no degree, In keeping with an Assessment via the Department of Schooling of a modern cohort of undergraduates. Several of these college students could not finish their diploma as the cost of attendance was as well large. About sixteen% of borrowers are in default – like approximately a third of senior citizens with college student financial debt – which may lead to The federal government garnishing a borrower’s wages or lowering a borrower’s credit score rating.

The HMDA info are quite possibly the most thorough publicly obtainable information on house loan marketplace activity. They are employed by industry, shopper teams, regulators, and Other folks to evaluate potential good lending risks and for other purposes.

Go over the borrower’s unpaid regular monthly desire, so that not like other current income-pushed repayment designs, no borrower’s loan balance will increase as long as they make their every month payments—even when that month-to-month payment is $0 due to the fact their cash flow is reduced.

In most cases, the higher your credit history rating, the decrease your vehicle loan interest level is probably going for being.

The HMDA details also recognize loans which are included by the house Ownership and Equity Safety Act (HOEPA). Less than HOEPA, certain varieties of mortgage loan loans that have interest fees or overall factors and costs earlier mentioned specified stages are matter to selected needs, which include more disclosures to buyers, and likewise are issue to numerous limits on loan conditions.

So how do we earn a living? Our associates compensate us. This will impact which merchandise 2022 loan we evaluation and generate about (and wherever those merchandise seem on the website), but it under no circumstances affects our tips or suggestions, which are grounded in A huge number of hours of research.

Since 1980, the entire cost of each 4-year community and 4-12 months personal college has almost tripled, even just after accounting for inflation. Federal help has not saved up: Pell Grants as soon as lined practically eighty p.c of the cost of a 4-yr community college diploma for college kids from Performing people, but now only include a third.

This strategy features qualified personal debt reduction as Element of an extensive work to deal with the burden of increasing college or university expenditures and make the coed loan process additional manageable for Operating people. The President is saying which the Division of Training will:

Black borrowers are twice as very likely to have received Pell Grants compared to their white peers. Other borrowers of colour may also be extra likely than their friends to receive Pell Grants. That is certainly why an Urban Institute review identified that financial debt forgiveness programs concentrating on those that received Pell Grants even though in faculty will progress racial equity.

Our companions are unable to fork out us to guarantee favorable evaluations of their merchandise or products and services. Here's a listing of our companions.

Just about eight million borrowers could be eligible to obtain aid routinely since their relevant profits facts is already available to the Department.

Investigate much more homeownership resourcesManaging a mortgageRefinancing and equityHome improvementHome valueHome insurance

Check out a lot more automobile insurance plan resourcesCompare automobile insurance policy ratesBest vehicle insurance policy companiesCheapest vehicle insurance plan companiesCar insurance coverage reviewsAuto insurance plan calculator

Owning this info, especially for borrowers by using a credit rating rating just like yours, offers you an idea of what rate to expect as well as a benchmark for comparing loan presents.

Anna Chlumsky Then & Now!

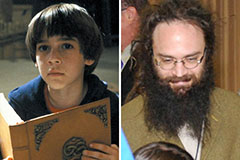

Anna Chlumsky Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!